States

ED moves SC seeking CBI FIR against West Bengal CM Mamata Banerjee over alleged obstruction of I-PAC raids

EW•NN | Jan. 12, 2026

Tamanna Rizvi | Jan. 12, 2026

EW•NN | Jan. 12, 2026

Sanjay Pandey | Jan. 12, 2026

Zaheet Mustafa | Jan. 12, 2026

Tamanna Rizvi | 1 month ago

EW•NN | 1 month ago

Sanjay Pandey | 1 month ago

Zaheet Mustafa | 1 month ago

ED moves SC seeking CBI FIR against West Bengal CM Mamata Banerjee over alleged obstruction of I-PAC raids

Swami Vivekananda: Strength, Spirituality, and National Awakening

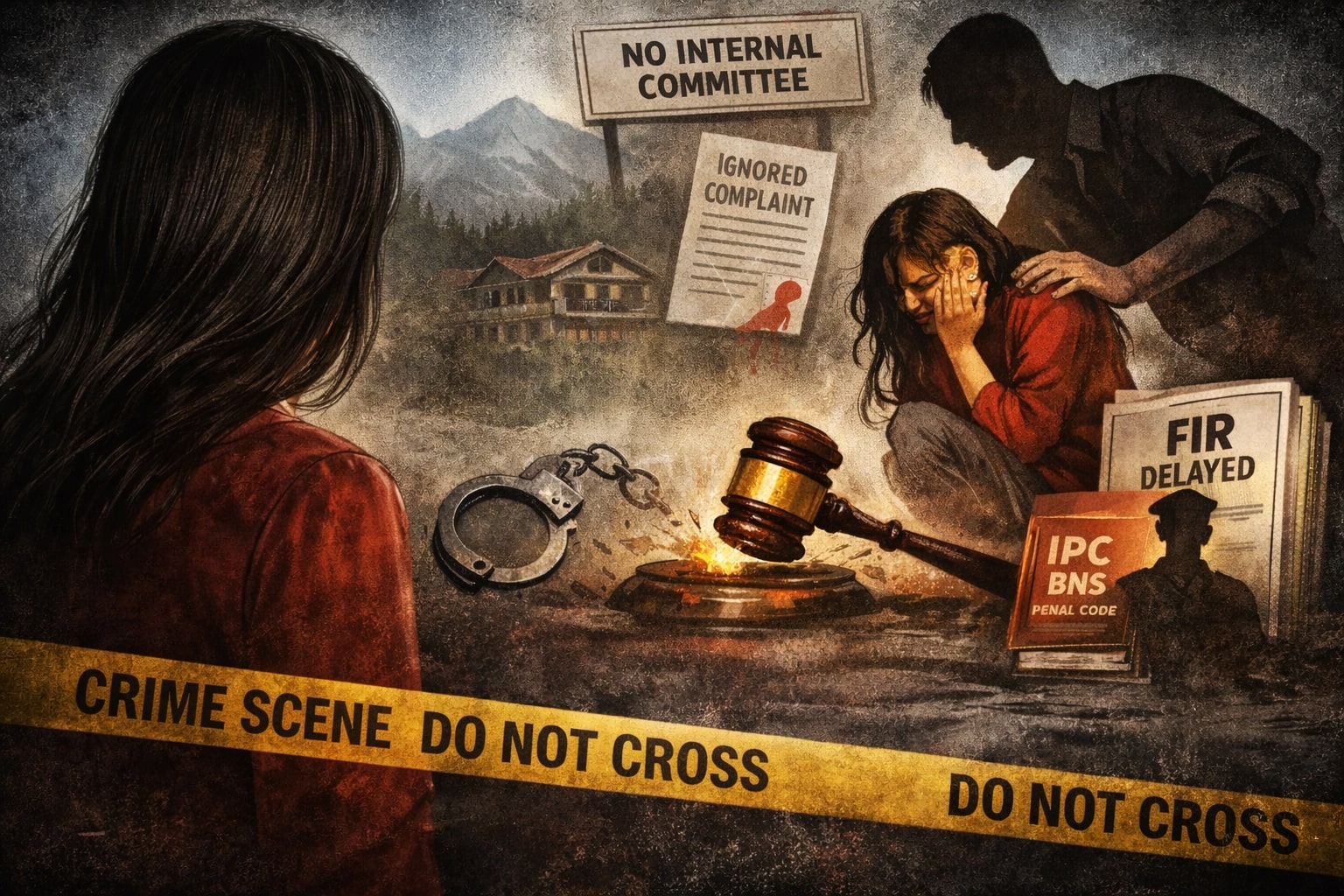

Decades Waiting for Justice: India’s Mounting Burden of Long-Pending Cases

India at the Threshold of an AI Moment: From Emerging Participant to Global Contender

Read More

Read More